The TUAC addresses the dangers of OECD basing policy on pre-crisis concepts (NAIRU etc and illusory inflation scares), in a post-crisis world of ever-rising private debt. OECD are forced to recommend co-ord fiscal expansion in event of slump

The Trade Union Advisory Committee (TUAC) to the OECD is an interface for trade unions with the OECD. It is an international trade union organisation which has consultative status with the OECD and its various committees.

Cross-posted from the TUAC website

Key messages

In its new edition of the Economic Outlook, the OECD is expecting a “soft landing” of the global economy as the latter is believed to already have reached its limits to expand much further. However, the OECD does not exclude a “sharper-than-expected-slowdown” resulting from the combined effects of a looming trade war, financial instability hitting emerging markets and a hike in oil prices. The OECD’s call on governments to be pro-active and start preparing the ground for an internationally coordinated fiscal expansion in case these downside risks indeed materialise is to be welcomed.

Nevertheless, when analysing market dynamics, the OECD is relying on the old and outdated concept of “non-accelerating inflation rate of unemployment’ (NAIRU) – an unfortunate revival of pre-crisis theory in a world where wage dynamics are almost flat. This contrasts with past OECD analysis. Indeed, over the past years, the message has been that the link between lower unemployment and wages had been broken. Given falling unemployment rates, wage dynamics should have been higher, thus supporting instead of holding back the economy.

It is also clear that the model of ‘finance-led growth’ needs to be abandoned and replaced by a model of ‘wage-led growth” where fair wages instead of ever increasing debt drive aggregate demand and economic activity forward. Otherwise, our economies will remain in the trap where “we cannot do without financial bubbles but can’t continue to rely on them either”. Here, TUAC welcomes the attention paid by the special chapter in the Outlook on the fact that real wage growth has been decoupled from productivity over the past two decades and that this has given rise to higher inequalities as productivity gains failed to be widely shared.

The Economic Outlook delivers two key messages.

The first one is that, with unemployment rates below pre-crisis levels in the majority of OECD countries and in many even below estimated sustainable rates, the global economy has reached its limits to expand further at a robust pace of growth. Hence, a ‘soft landing’, in other words a deceleration of growth to a lower rate, is not just in the pipeline but actually even desirable in order to avoid the risk of a sharper upturn in inflation. From the point of view of the OECD, the most important consequence for policy is that structural reform ambition needs to be improved so potential growth performance can be improved. Here, the OECD refers to policy easing product market regulation and increasing spending on active labour market policies but also to action to improve redistribution through taxes and social transfers.

The other message is that a ‘harder-than expected landing’ cannot be excluded if risks to the downside materialise and reinforce each other. Increasing trade tensions together with tighter financial conditions and capital outflows deepening the emerging economies’ crisis and combined with a hike in oil prices would produce a ‘sharper-than-expected-slowdown”. To quickly respond to this, international dialogue and institutions should then be used to organise a coordinated fiscal stimulus. In terms of concrete numbers, the OECD estimates that a three-year fiscal expansion of 0.5% of GDP across all countries and regions would limit the downside risk and support global economic activity by an identical 0.5% of GDP, even when this is accompanied by a modest rise in the government debt-to- GDP ratio.

Is the OECD going back to “pre-crisis” economic theory?

The NAIRU: A misleading concept

Unemployment is indeed down below pre-crisis levels. However, whereas the OECD was previously insisting on the fact that, despite low unemployment, substantial labour market slack was remaining, the focus is now shifting to the assertion that “resource constraints’ are increasing, that there are signs of labour shortages and that unemployment in many economies is below estimated sustainable rates, also known as NAIRU (Non Accelerating Inflation Rate of Unemployment).

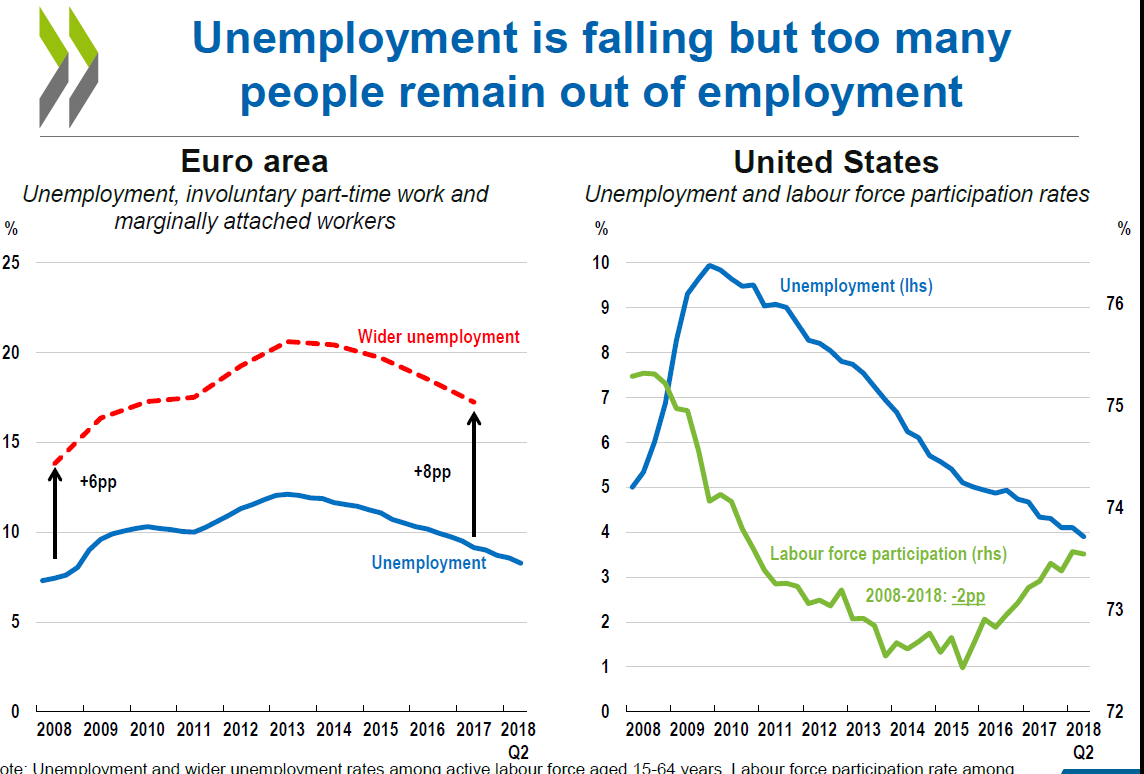

The graph below, taken from the OECD Interim Outlook published just a few months ago, counteracts the previous as it shows that the degree of labour market slack is indeed still significant when involuntary part-time and marginally attached workers are added to the formal unemployment statistics. In the Euro Area, this wider measure of unemployment remains some 2 percentage points above the pre-crisis level and zooming in on individual euro area members such as Italy or Spain would reveal even much higher labour market slack. In the US, labour force participation rates are still a long way off the pre-crisis levels, thus giving rise to the remarkable phenomenon observed over recent quarters of the economy creating hundred thousands of jobs while unemployment is only slowly falling because discouraged workers are being drawn back into the labour force.

As the real labour market slack that is behind the official unemployment rate is shifting over time, the concept of the NAIRU is misleading and boils down to comparing oranges with peaches: A (for example) 5% unemployment rate in 2018 does no longer compare with the same unemployment rate ten or twenty years ago. Relying on the NAIRU thus raises the danger of deciding to withdraw aggregate demand support demand even when the economy still has more room to grow. Opportunities are missed to get more workers who are still on the sideline back into the labour market, to create more jobs, to trigger a ‘high-pressure’ labour market boosting investment and productivity, in short to get us back to the living standards that would have been expected on the basis of pre-crisis trends.

High inflation is not behind the corner

Linked with the concept of the NAIRU or structural unemployment is the Outlook’s concern of wage growth turning out to be stronger than projected, thus adding to inflationary pressures and resulting in a sharper upturn of inflation.

This represents another shift in the OECD’s approach. Indeed, over the past years, the message has been that the link between lower unemployment and wages was broken, that given the falling unemployment rates wage dynamics should have been much higher and that such modest wage growth was holding back the economy.

This pattern can still be observed in some way in the graphs published by the current Outlook. In the graphs below, one can see that the most recent data points (in colour) are at the absolute bottom of the range of points connecting (cyclical) unemployment with nominal wage growth. Given experience, wage growth should be much more substantial, both in the US as well as in the Euro Area.

However, the current Outlook turns around the interpretation of these data: Instead of pointing to nominal wage growth being substantially more modest than would be expected based on the state of the labour market, the reading now becomes the opposite, a warning against the possibility of much higher wage growth. This is done by arguing that “wage growth has sometimes strengthened in a non-linear manner in the past as labour markets tighten”.

There is no basis to prefer the latter interpretation to the former. Moreover, the latter interpretation may have been informed by the somewhat surprising change in second quarter 2018 wage growth in the Euro Area from 1, 5 to 2, 25%. This however appears to be driven largely by a one-off increase in public sector wages in Italy.

In any case, with core inflation still at overly modest levels (between 1 to 1,25% in the median OECD economy), stronger wage growth (if it does materialise) will help bringing inflation in line with the price stability mandate of central banks, thus constituting a buffer against future disinflationary shocks.

The downside scenario may already be here

In the current Outlook, OECD growth is projected to slow down from 2.4% in 2018 to 1,9% by 2020, with the US doing marginally better (2,1%) and the Euro Area and Japan doing (much) worse (1,6% and 0,7% respectively). This implies a return to the same pattern of modest growth performance that has characterised the post-crisis recovery and which is almost half of the pre-crisis long-term growth trend.

Bottom line for growth: OECD averag

However, the OECD may be erring on the positive side of things when forecasting a slowdown from 2.4% to around 2%. Indeed, most recent economic indicators have been dismal. The Italian economy has showed no growth and the German and Japanese economy have actually shrunk in the third quarter. While one-off factors played a certain role, a weakening of exports flows is one of the driving factors. In addition, global manufacturing export orders do not bode well for growth either (see graph below from the Bank of England).

Hence, it may be the case that the downside risk scenario the OECD is also referring to is already materialising itself and that OECD growth, even if no new shocks appear on the horizon, would turn out to be weaker and below 2%. This may be partly related to the ‘war on global trade’, the emerging economies crisis and an ongoing slowdown in the Chinese economy, as the OECD says. However, it has also to do with the change in monetary policy and with the withdrawal of quantitative easing together with rising interest rates working to prick financial bubbles in the advanced economies themselves. In particular, too many corporations are now being exposed as having engaged in unsustainable debt positions by putting money in speculative financial operations (stock buy backs, dividends, mergers and acquisitions) instead of investing in productive capacity (see green bars in graph below showing the rise in non-financial corporate debt). This once again shows that the model of ‘finance-led growth’ needs to be abandoned and replaced by a model of ‘equity-led growth” where fair wages instead of ever increasing debt drive demand and economic activity forward. Otherwise, our economies will remain in the trap where “we cannot do without financial bubbles but can’t continue to rely on them either”.

Conclusion

The OECD’s pro-active call in favour of an internationally coordinated fiscal expansion in case of downside risks, as well as the attention paid to wages systematically lagging behind productivity, is certainly to be welcomed. At the same time, it is worrying that, at least in the text of the OECD, pre-crisis concepts such as structural unemployment are reappearing. The OECD may also be behind the growth curve as third quarterly outcomes and leading indicators are showing a pronounced weakening of economies.

Be the first to comment