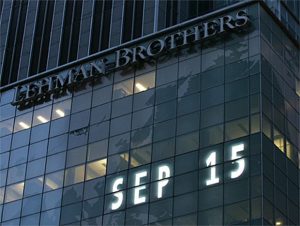

“In the autumn of 2008 events unfolded in Wall Street that the crushing majority of people around the world had been led to believe could never occur. It was the financial equivalent of watching the sun spinning out of control soon after it rose above the horizon. Humanity watched on in collective disbelief. The ancient Greeks had a term for moments like that one: aporia – a state of intense bafflement urgently demanding a new model of the world we live in. The Crash of 2008 was such a moment. Suddenly, the world ceased to make sense in terms of what, a few weeks before, passed as conventional wisdom.”

Read here

Be the first to comment