Previous research suggests a form of ‘democratic constraint’ blocks attempts to reform the euro. While voters in creditor countries oppose debt sharing across the Eurozone, voters in debtor countries are unwilling to push for change by threatening to leave the single currency.

Lucio Baccaro is Director, and Björn Bremer and Erik Neimanns are Senior Researchers, at the Max Planck Institute for the Study of Societies in Cologne

Cross-posted from LSE EUROPP

Drawing on a new study, the authors claim this argument overlooks the fact citizens in debtor countries are receptive to information about the costs of remaining in the euro, and that citizens in creditor countries are concerned about the costs of a breakup.

The sovereign debt crisis of the early 2010s was never truly resolved, but merely put on hold by the European Central Bank. Mario Draghi’s promise to do “whatever it takes” to save the euro in July 2012 was essential in defusing the danger of a breakup of Europe’s common currency. Later on, the ECB’s asset-purchase programme, which saw the central bank buy government bonds, provided further relief to highly indebted nations.

When Covid-19 struck, causing a significant decline in GDP in several nations and a big increase in public deficits, it fell again on the ECB to resolve the situation. Public debt levels soared, surpassing 150% of GDP in Italy and reaching 120% in Spain, but the Pandemic Emergency Purchase Programme (PEPP) kept bond spreads under control.

Still, the institutional architecture of the euro is conducive to confidence crises because it is meant to expose sovereign bonds to market discipline while prohibiting fiscal transfers, monetary financing, and risk-sharing among member nations. It is commonly acknowledged that adding fiscal transfer or risk-sharing mechanisms would strengthen the euro’s foundation. This is why the introduction of ‘Eurobonds’ was the subject of passionate debate during the Eurozone crisis. However, none of the reform proposals were successful.

Democratic constraint

Academic researchers have argued that what blocks the path towards the institutionalisation of fiscal risk-sharing in the Eurozone is a ‘democratic constraint’ or a ‘constraining dissent’. National public opinion in northern countries is vehemently opposed to providing financial assistance to ‘profligate’ southern countries. Consequently, northern leaders, who are accountable to their constituents, have little room to deviate from the current setup.

In turn, southern politicians confront their own version of the democratic constraint: the ability to threaten a breakup of the common currency would improve their negotiating position. Despite punishing austerity and structural reforms, however, their constituents are hesitant to consider quitting the euro. As the negotiations around the third Greek bailout painfully demonstrated, this weakens their leaders’ ability to negotiate a more equitable distribution of the burden of adjustment.

While these remain popular arguments, we believe that the democratic constraint concept is overly static. It is true that without any genuine motivation or compulsion to reform, northern leaders will do the bare minimum to keep the euro afloat and that this will be insufficient to place the euro on a more stable footing. However, it is also true that preferences for fiscal integration are ‘strategically interdependent’, i.e. dependent on expectations regarding the actions of other actors. In turn, expectations are influenced by the type of information citizens receive about the costs and benefits of different policies.

In other words, whether or not northern citizens agree to fiscal risk-sharing will depend on whether they have information about the costs associated with a refusal to do so. In contrast, southern Europeans’ willingness to leave the euro depends on their evaluation of the costs and benefits, which includes their anticipation of the response of other nations.

Importantly, the same information concerning costs and benefits will be processed differently depending on whether the economic impact of keeping the euro is appraised as a good thing (domain of gains) or as a bad thing (domain of losses). In the first case, citizens will be risk-averse and biased toward maintaining the status quo, whereas in the second, they will be risk-seeking and slanted toward change.

The above implies that northern citizens will accept some form of fiscal risk-sharing if a systemically important southern country threatens to leave the euro. The southern country will make this threat if its citizens prefer paying the costs of a breakup (disorderly exit) to paying the costs of remaining in the eurozone (austerity and structural reforms).

An empirical test

In a recent study, we test these hypotheses by focusing on a key debtor country, Italy, and a key creditor country, Germany. We ran two linked survey experiments in late March 2020, sampling 2,118 and 2,246 respondents in Italy and Germany, respectively, from a large pool of individuals. Respondents in both countries were asked to consider a common hypothetical scenario in which Italy faces a financial crisis: as the government is unable to fulfil its financial obligations, other European countries offer a bailout package.

Respondents in Italy were further informed that “before deciding whether to accept or not the bailout package, the government calls a referendum about whether to stay in the euro and thus accept the bailout package, or reject the bailout package and therefore exit the euro.” The respondents were then asked how they planned to vote in this referendum.

Respondents in Germany were informed that the Italian government is unwilling to sign a bailout plan, “which would condition the disbursement of funds on the implementation of austerity measures, and is contemplating exit from the euro.” The German respondents were then asked if they desired the German government to work to prevent or promote Italexit.

The basic scenario was assigned to the control group. The other experimental groups, randomly assigned, received additional information about the costs of ‘Italremain’ or ‘Italexit’ for Germany and Italy, respectively. For Italy, the costs of remain scenario stressed that the European bailout plan was contingent on the implementation of austerity policies and structural reforms. In contrast, the costs of exit scenario highlighted the costs of a disorderly exit from the euro for Italy.

For Germany, the costs of remain scenario emphasised the need for Germany to agree to some form of debt mutualisation to keep Italy in the eurozone. The costs of exit scenario concentrated on the negative implications of a collapse of the euro for the competitiveness of the German export industry.

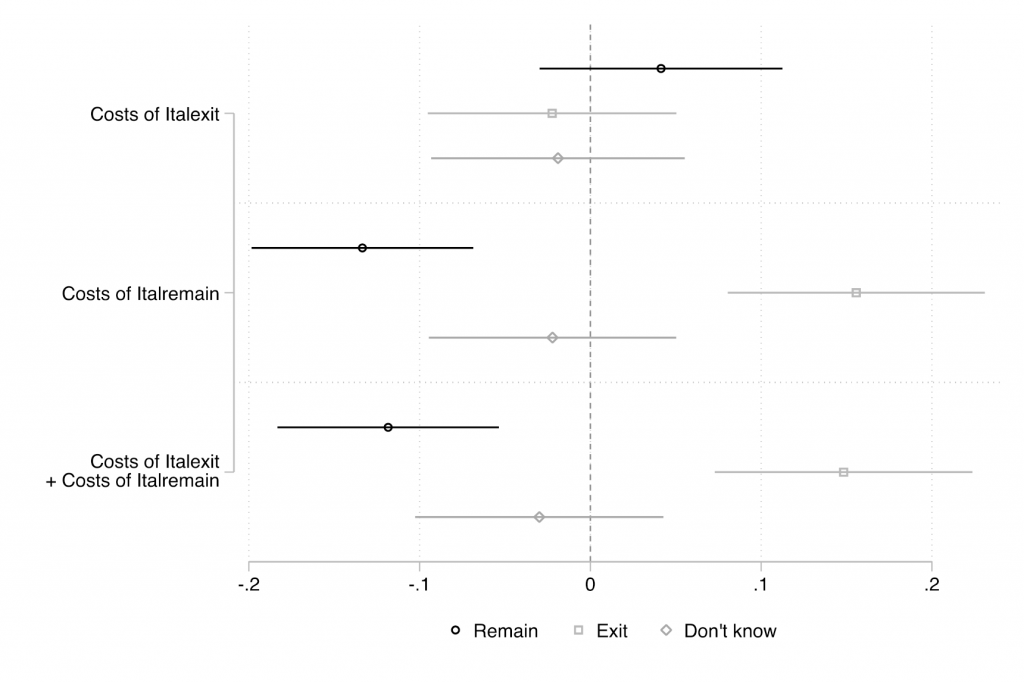

The treatment effects (reported in Figure 1) suggest that Italians, who are likely to assess the crisis scenario from the domain of losses, weigh the costs of remaining in the eurozone (austerity and structural reforms) much more heavily than the costs of a disorderly exit. They increase their preferences for exit by 15% when they receive the cost of remain scenario, while the cost of exit scenario hardly moves preferences at all.

Figure 1: Average treatment effects of frames on preferences toward Italexit in Italy

Note: Average treatment effects and 95 percent confidence intervals based on multinomial probit models.

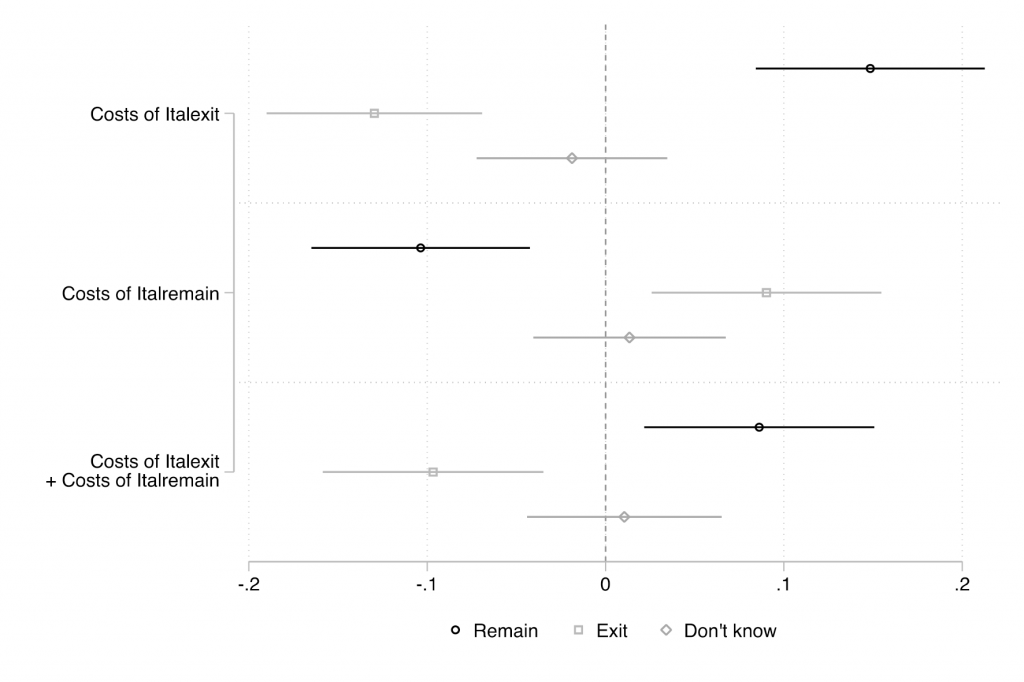

In Germany, both informational scenarios move preferences, in opposite directions (Figure 2). Yet, for Germans, who are likely to evaluate the crisis scenario from the domain of gains and are thus more risk averse, the impact of highlighting the costs of Italexit is greater than highlighting costs of Italremain. Overall, when there is a serious risk of euro disintegration, German citizens are willing to authorise fiscal risk-sharing.

Figure 2: Average treatment effects of frames on preferences toward Italexit in Germany

Note: Average treatment effects and 95 percent confidence intervals based on multinomial probit models.

Beyond the issue of debt mutualisation in the Eurozone, our findings have far-reaching consequences for how we study preferences for international integration and disintegration. First, acceptance of deeper integration is enhanced when citizens of nations that are ‘winners’ of economic integration are primed to consider the costs of integration coming apart as a result of their partners’ frustration.

Second, citizens of countries that are on the ‘losing’ end tend to underestimate the costs of disintegration, and this leads them to become more risk-seeking in their response. This is a significant source of instability, as the example of Brexit also demonstrates. Finally, in a world of incomplete information and radical uncertainty, preferences are neither unconditional nor fixed, but respond to the type of information citizens receive, giving national leaders the opportunity to shape the public’s response.

For more information, see the authors’ accompanying paper in the Review of International Political Economy

Note: This article gives the views of the authors, not the position of EUROPP – European Politics and Policy or the London School of Economics. Featured image credit: European Council

Support us and become part of a media that takes responsibility for society

BRAVE NEW EUROPE is a not-for-profit educational platform for economics, politics, and climate change that brings authors at the cutting edge of progressive thought together with activists and others with articles like this. If you would like to support our work and want to see more writing free of state or corporate media bias and free of charge. To maintain the impetus and impartiality we need fresh funds every month. Three hundred donors, giving £5 or 5 euros a month would bring us close to £1,500 monthly, which is enough to keep us ticking over.

Adversarial negotiations are not part of an optimal currency area, and hardly the basis for a political union. Until we see each other as equals, which there is still no indication of ever happening, it will be disfunctional and undemocratic. Pragmatic last minute concessions don’t change that.