A capitalist’s theory of capitalism’s demise.

Michael Roberts is an Economist in the City of London and a prolific blogger.

Cross-posted from Michael Roberts’ blog

Ruchir Sharma has a book out called What went wrong with capitalism? Ruchir Sharma is an investor, author, fund manager and columnist for the Financial Times. He is the head of Rockefeller Capital Management‘s international business, and was an emerging markets investor at Morgan Stanley Investment Management.

With those credentials of being ‘inside the beast’ or even ‘one of the beasts’, he ought to know the answer to his question. In a review of his book in the Financial Times, Sharma outlines his argument. First, he tells us that “I worry about where the US is leading the world now. Faith in American capitalism, which was built on limited government that leaves room for individual freedom and initiative, has plummeted.” He notes that now most Americans don’t expect to be “better off in five years” — a record low since the Edelman Trust Barometer first asked this question more than two decades ago. Four in five doubt that life will be better for their children’s generation than it has been for theirs, also a new low. And according to the latest Pew polls, support for capitalism has fallen among all Americans, particularly Democrats and the young. In fact, among Democrats under 30, 58 per cent now have a “positive impression” of socialism; only 29 per cent say the same thing of capitalism.

This is bad news for Sharma as a strong supporter of capitalism. What has gone wrong? Sharma says that it’s the rise of big government, monopoly power and easy money to bail out the big boys. This has led to stagnation, low productivity growth and rising inequality.

Sharma argues that the so-called neoliberal revolution of the 1980s that supposedly replaced Keynesian-style macro management, reduced the size of the state and deregulated markets was really a myth. Sharma: “the era of small government never happened.” Sharma points out that in the US, government spending has risen eight-fold since 1930 from under 4 per cent to 24 per cent of GDP — and 36 per cent including state and local spending. Alongside tax cuts, government deficits rose and public debt rocketed.

As for deregulation, the result was actually “more complex and costly rules, which the rich and powerful were best equipped to navigate.” Regulatory rules actually increased. As for easy money, “fearful that mounting debts could end in another 1930s-style depression, central banks started working alongside governments to prop up big corporations, banks, even foreign countries, every time the financial markets wobbled.” So there was no neoliberal transformation freeing up capitalism to expand, on the contrary.

But is Sharma’s economic history of the period after the 1980s really right? Sharma tries to portray the post-1980s period as one of bailouts for banks and companies during crises in contrast to the 1930s when central banks and governments followed the policy of ‘liquidation’ of those in trouble. Actually, this is not correct, saving corporate capital and the banks was the driving force of the Roosevelt New Deal; liquidation was never adopted as government policy. Moreover, the 1980s were mostly a decade of high interest rates and tight monetary policy imposed by central bankers like Volcker, seeking to drive down the inflation of the 1970s. Indeed, Sharma has nothing to say about the ‘stagflation’ of the 1970s – a decade, according to him, where capitalism had small government and low regulation.

Sharma makes much of the rise in government spending including ‘welfare spending’ in the last 40 years. But he does not really explain why. After the rise in spending and debt during the war, much of the increased spending since has been due to a rise in population, particularly a rise in the elderly, leading to an increase in (unproductive for capitalism) spending on social security and pensions. But the rise in government spending was also a response to the weakening of economic growth and investment in productive capital from the 1970s. As GDP grew more slowly and welfare spending grew faster, then government spending to GDP rose.

Sharma says nothing about other aspects of the neo-liberal period. Privatisation was a key policy of the Reagan and Thatcher years. State assets were sold off to boost profitability in the private sector. In this sense, there was a reduction in the ‘big state’, contrary to Sharma’s argument. Indeed, starting as early as the mid-1970s, public sector capital stock was sold off. In the US, it has been halved as a share of GDP.

Source: IMF investment and capital stock database, 2021

Similarly, post the 1980s, public sector investment as a share of GDP has been nearly halved while the private sector share has risen 70%.

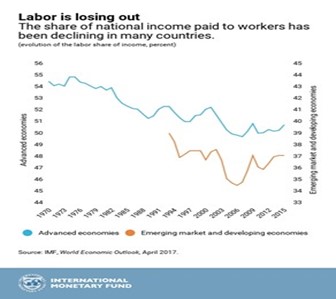

It’s not the ‘big state’ that is in control of investment and output decisions, it is the capitalist sector. This hints at the reason for reducing the role of the public sector. The problem for capitalism in the late 1960s and 1970s was the drastic fall in the profitability of capital in the major advanced capitalist economies. That fall had to be reversed. One policy was privatization. Another policy was the crushing of the trade unions through laws and regulations designed to make it difficult if not impossible to set up unions or take industrial action. Then there was the move of manufacturing capacity out of the ‘Global North’ to the cheap labour regions of the Global South, so-called ‘globalization’. Combined with weakening trade unions at home, the result was a sharp drop in the share of GDP going to labour along with cheap labour abroad; and a (modest) rise in profitability of capital.

Sharma admits that “globalisation brought more competition, keeping a lid on inflation in consumer prices” against his thesis of monopoly stagnation, but then argues that globalization and low imported goods prices “solidified a conviction that government deficits and debt don’t matter.” Really? Throughout the 1990s onwards, governments tried to impose ‘austerity’ in the name of balancing budgets and reducing government debt. They failed, not because they thought that ‘deficits and debt don’t matter’ but because economic growth and productive investment slowed. Public sector spending cuts were significant, but the ratio to GDP did not fall.

Sharma reckons that ‘recessions were fewer and farther between’ in the post-1980s period. Hmm. Leaving out the huge double slump of the early 1980s (another key factor in driving down labour power), there were recessions in 1990-1, 2001 and then the Great Recession of 2008-9, culminating in the pandemic slump of 2020, the worst slump in the history of capitalism. Maybe fewer and farther between, but increasingly damaging.

Sharma notes that after each slump since the 1980s, economic expansion has been weaker and weaker. This appears as a mystery for proponents of capitalism. “Behind the slowing recoveries was the central mystery of modern capitalism: a collapse in the rate of growth in productivity, or output per worker. By the outset of the pandemic, it had fallen by more than half since the 1960s.”

Sharma presents his explanation: “a growing body of evidence points the finger of blame at a business environment thick with government regulation and debt, in which mega-companies thrive and more corporate deadwood survives each crisis.” The bailouts of the big monopolies (‘three of every four US industries have ossified into oligopolies’) and ‘easy money’ have kept a stagnating capitalism crawling along, breeding ‘zombie’ companies that only survive by borrowing.

Sharma puts the horse before the cart here. Productivity growth slowed across the board because productive investment growth dropped. And in capitalist economies, productive investment is driven by profitability. The neo-liberal attempt to raise profitability after the profitability crisis of the 1970s was only partially successful and came to an end as the new century began. The stagnation and ‘long depression’ of the 21st century is exhibited in rising private and public debt as governments and corporations try to overcome stagnant and low profitability by increasing borrowing.

Sharma proclaims that social “immobility is stifling the American dream.” Whereas, in the rosy past of ‘competitive capitalism’, through dint of hard work and entrepreneurial drive, you could go from rags to riches, now that is not possible. But the ‘American dream’ was always a myth. The majority of billionaires and rich people in the US and elsewhere inherited their wealth and those that did become billionaires in their lifetime did not do so without sizeable start-up funds from parents etc.

And let me add, Sharma’s thesis is entirely based on the advanced capitalist economies of the Global North. He has little to say about the rest of the world where most people live. Has social mobility been stymied or never existed? Is there a big state with massive welfare spending in these countries? Is there easy money for companies to borrow? Are there domestic monopolies squeezing out competition? Are there bailouts galore?

That brings us to Sharma’s main message about what is wrong with capitalism. You see, for Sharma, capitalism as he envisages it no longer exists. Instead, competitive capitalism has morphed into monopolies bolstered by a big state. “Capitalism’s premise, that limited government is a necessary condition for individual liberty and opportunity, has not been put into practice for decades.”

The myth of a competitive capitalism that Sharma projects sounds similar to the thesis of Grace Blakeley in her recent book, Vulture Capitalism, where she argues that capitalism has never really been a brutal battle between competing capitalists for a share of the profits extracted from labour, but instead a nicely agreed and planned economy controlled by big monopolies and backed by the state.

In effect, both Sharma and Blakeley agree on the rise of ‘state monopoly capitalism’ (SMC) as the reason for what went wrong with capitalism. Of course, they differ on the solution. Blakeley, being a socialist, wants to replace SMC with democratic planning and workers coops. Sharma, being ‘one of the beasts’, wants to end monopolies, reduce the state and restore ‘competitive capitalism’ to follow its ‘natural path’ to provide prosperity for all. Sharma: “capitalism needs a playing field on which the small and new have a chance to challenge — creatively destroy — old concentrations of wealth and power.”

You see, capitalists, if left alone to exploit the labour force, and freed of the burden of regulations and for having to pay for welfare spending, will naturally flourish. “The real sciences explain life as a cycle of transformation, ashes to ashes, yet political leaders still listen to advisers claiming they know how to generate constant growth. Their overconfidence needs to be contained before it does more damage.” So, according to Sharma, capitalism will be fine again, if we let the capitalist cycles of boom and slump play out naturally and not try to manage them.

“Capitalism is still the best hope for human progress, but only if it has enough room to work.” Well, capitalism has had plenty of room to work for over 250 years with its booms and slumps; its rising inequalities globally; and now its environmental threat to the planet; and the increasing risk of geopolitical conflict. No wonder 58% of young Democrats in the US would prefer socialism.

Due to the Israeli war crimes in Gaza we have increased our coverage from five to six days a week. We do not have the funds to do this, but felt that it was the only right thing to do. So if you have not already donated for this year, please do so now. To donate please go HERE.

Be the first to comment