As we have learnt in the past, austerity and interest rates are tools of the rich in their class war against the rest of us.

Richard Murphy is an economic justice campaigner. Professor of Accounting, Sheffield University Management School. Chartered accountant. Co-founder of the Green New Deal as well as blogging at Tax Research UK

Cross-posted from Tax Research UK

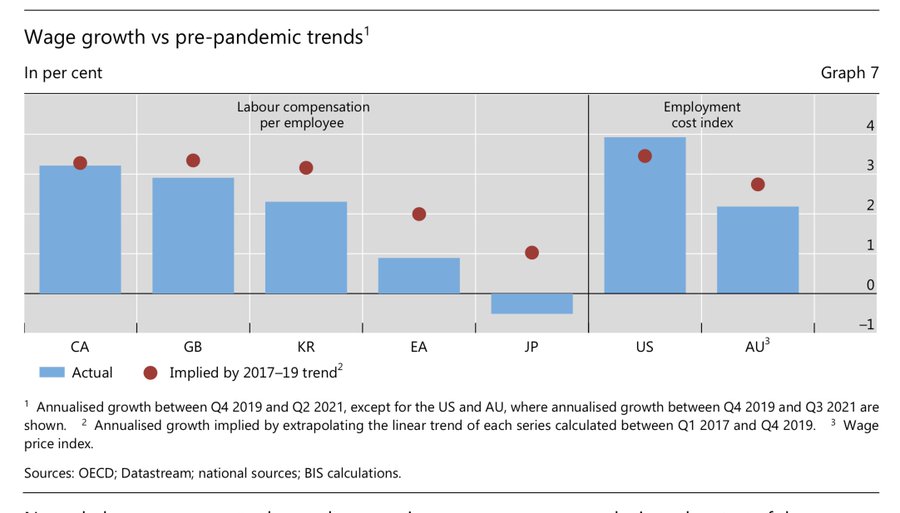

… average wage growth since the start of the pandemic in the €zone has been even below its pre-pandemic trend. Zero hints at a wage-price spiral.

This sort of post from a responsible journalist is commonplace this morning:

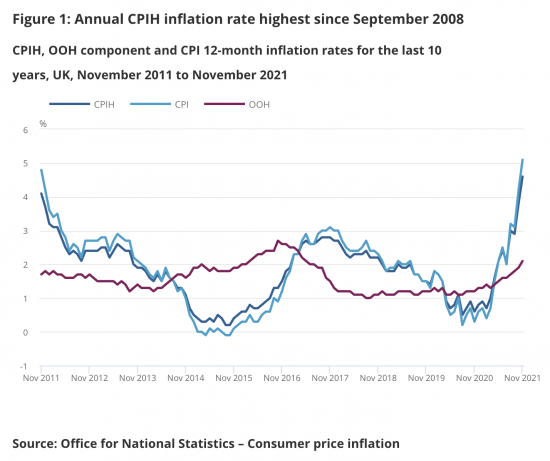

The Office for National Statistics has published data this morning showing that inflation is at its highest rate since September 2008:

It’s as if the Global Financial Crisis never happened. And that is the key thing to remember when appraising the demand that many will be making that the Bank of England respond to this increase by in turn increasing its base interest rate this week, probably from 0.1% to 0.25%.

The very people who are making that demand are precisely the same people who also want us to get back to what they call ‘normal’. This, in their view, is the world as it was before that Global Financial Crisis. Most especially, what they recall is that there were positive interest rates for depositors before that time and they wish that situation to be restored for the benefit of wealth holders, who we can presume include them in their number.

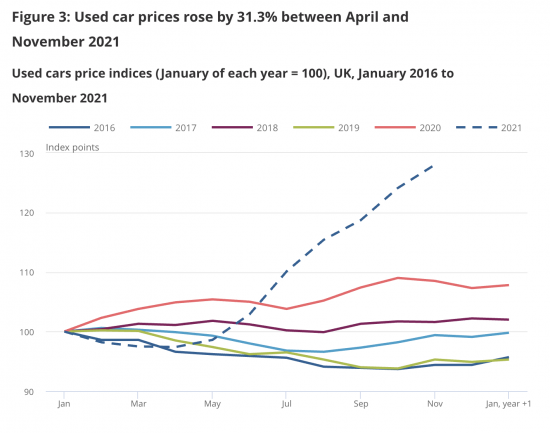

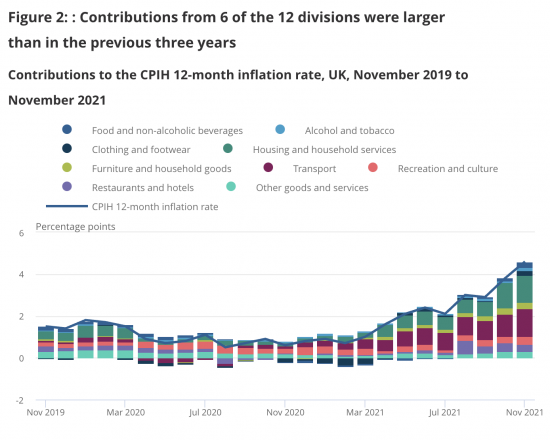

There are three things to note. The first is that the biggest contributor to this increase in inflation is fuel costs, whether those are for domestic energy or motor fuel costs. There is absolutely nothing the interest rate change will do to influence this price. That is also true of some other factors that have inflated this index, including the extraordinary increase in the price of secondhand cars, which this chart demonstrates:

There are a lot of people who are going to make some very heavy losses on the vehicles that they have bought recently. In fact, in this case the one thing that you can be sure of is that this price change is very definitely going into reverse sometime relatively soon: it is quite impossible that secondhand cars can maintain these prices in the long-term. The consequence will, of course, mean that inflation will reduce.

In other cases, it is important to note that the inflation is likely to be one-off. In other words, whilst there have been increases we will not see a similar pattern in a year’s time. In that case, simply because of the way in which this index is calculated inflation will fall, significantly, at that time. This is the second reason why the Bank of England does not need to react now to this data. Imposing a real cost on the economy to address a self-correcting situation makes no sense at all.

Third, if the overall composition of inflation increases is noted it is transport and housing and household service costs that have increased dramatically. If they were reduced rate seen only a short time ago and there would be nothing much to comment on now.

So, as already noted, much of this issue is wholly beyond the reach of interest rate changes. In that case unless it is the desire of the Bank of England to put increased pressure on household budgets that are already stretched to the limits they should do nothing this week. If they do I will applaud them for their inaction, which would be wholly appropriate.

So, as already noted, much of this issue is wholly beyond the reach of interest rate changes. In that case unless it is the desire of the Bank of England to put increased pressure on household budgets that are already stretched to the limits they should do nothing this week. If they do I will applaud them for their inaction, which would be wholly appropriate.

But, if they do increase rates then we will have to come to the conclusion that the Bank of England is, at the very least, a bunch of economic sociopaths who put dogma before evidence and who wish to trash the economy at a time of enormous stress within society, and that should worry us all. It will be interesting to see what happens.

Richard Murphy

Be the first to comment