Banks aren’t “financial intermediaries”, and government spending creates money, rather than borrowing it

Steve Keen is an Australian economist and author. A post-Keynesian, he criticizes neoclassical economics as inconsistent, unscientific and empirically unsupported.

Cross-posted from Steve Keen’s Building a New Economics

In the first post in this series, I asserted that cutting government spending won’t lead to increased investment, as Rachel Reeves believes, because her argument is based on a false theory of money. She was taught it when she learnt economics at University, and not only Reeves, but the vast majority of economists, believe this theory, called “Loanable Funds”. But it is demonstrably false.

This might seem crazy—and frankly, it is crazy that economics textbooks teach a false model of money. But that’s the reality, as Reeves’ one-time employer, the Bank of England, stated in 2014:

“The reality of how money is created today differs from the description found in some economics textbooks” (McLeay, Radia, and Thomas 2014).

The Bank then explained how money is created by banks, and it’s outrageously simple:

Rather than banks receiving deposits when households save and then lending them out, bank lending creates deposits.

I’ll explain why economists teach and believe a fallacy in a later post. Here, I’ll show why the Bank of England is right, using the same tool that banks use to create money: double-entry bookkeeping. Banks don’t have a “Magic Money Tree”, but they do have accountants, who apply the rules of double-entry bookkeeping. Combined with the fact that Banks, and only Banks, can offer Deposit accounts, the rules of double-entry bookkeeping give them the power to create money.

How Banks Create Money

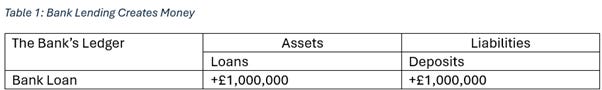

When a bank makes a loan, it puts an amount of money in the borrower’s bank account—say, £1 million—and it puts the same sum into the borrower’s loan account:

The Deposit is the bank’s Liability. The Loan is the bank’s Asset. We use Bank deposit accounts (and cash) as money. Therefore, the ability that banks have to mark up both their Assets and their Liabilities is what enables them to create money.

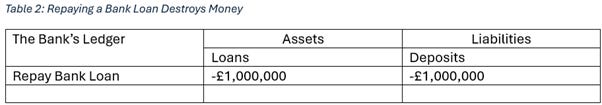

The converse applies as well: when a borrower repays a loan, this destroys money. The Bank’s Liabilities fall, and so does its Assets.

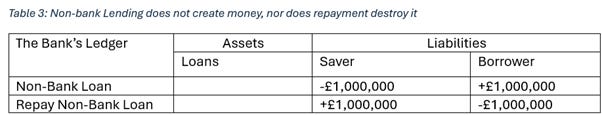

On the other hand, a “person to person” loan does not create money, because it’s a transfer of money from one bank account to another. The Liabilities of the banking sector remain constant, and the banking sector’s Assets are unaffected.

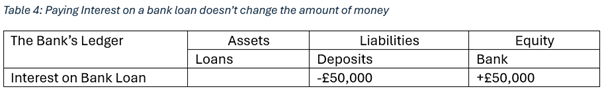

Similarly, the payment of interest on a loan doesn’t alter the Assets of the Bank. Instead, it transfers money from the Bank’s Liabilities to the Bank’s Equity—the short-term equity out of which a bank can spend. This, after all, is why a Bank offers loans in the first place: because the income from interest on the loan increases its net worth.

There is a general rule here: to create money, a financial operation has to increase both the Assets, and the Liabilities or Equity, of the banking sector. Any banking operation that doesn’t do this, doesn’t create money.

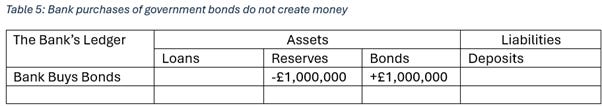

For example, if a bank buys Treasury Bonds using its Reserves, this neither creates nor destroys money. Reserves and Bonds are both Assets of the Banking sector. Reserves fall and Bonds rise, but the aggregate value of the Banks’ assets remains constant. This also means that its Liabilities and Equity are unaffected, so money is not created—or borrowed, or destroyed. Treasury Bond sales to banks have no effect on the supply of or demand for money.

These general principles about how banks operate can be applied to government spending and taxation as well, since they also work through the banking system.

How the Government Creates Money

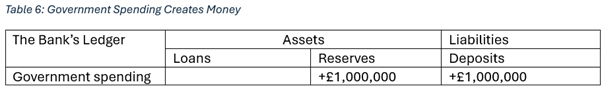

When the government spends, it credits private bank accounts. How does the government get the banks to add to their Liabilities? It increases the banks’ Assets at the same time: the Asset we call “Reserves”. Government spending therefore increases Bank Liabilities and Bank Assets simultaneously—just as bank lending does—and it therefore also creates money. The key difference is that the Assets increased by bank lending are Bank Loans, whereas the Assets increased by government spending are Bank Reserves.

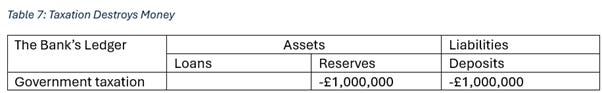

Similarly, taxation takes money out of deposit accounts and therefore reduces bank liabilities—destroying money. The matching operation on the Asset side of the Banks’s ledger is the reduction in Reserves.

This is the reality that Reeves doesn’t understand, because she has accepted the false models of banking promulgated by mainstream economists, their economics courses, and their textbooks. Government spending doesn’t take money from the private sector, it creates money for the private sector. In terms that someone who still thinks in terms of supply and demand curves will hopefully understand, government spending doesn’t add to the demand for money, it adds to the supply of money.

This is why Reeves’s policies will backfire. She thinks that, by “balancing the books” and eliminating treasury bond sales, she is freeing up money which can then be used by the private sector for investment. Instead, she will reduce the growth rate of the money supply, which if anything will reduce investment as well.

In the next post, I’ll explain why the thing that Reeves is obsessed with reducing—British government debt, denominated in British pounds, in the form of British Government Bonds—isn’t the problem that her economics textbooks told her it was.

Excellent article. Should be required reading for every economics, social and political studies student and every aspiring politician. We live in a critical time facing combined ecological, economic, social and political melt downs. To prevent mass global poverty, resource depletion, irreversible global warming and major social unrest we must get to grips with the alternative thinking and total solution that you seek.