This is how democracy works these days

Thomas Ferguson is Professor Emeritus, University of Massachusetts, Boston

Paul Jorgenson is Associate Professor and Director of Environmental Studies, University of Texas Rio Grande Valley

Jie Chen is University Statistician, University of Massachusetts

Cross-posted from INET

Late last week, Samuel Bankman-Fried, in the eyes of many our century’s answer to 18th-century fraudster John Law, Charles Ponzi, and the con artists who puffed tulips back in the Dutch Golden Age, allowed that he would be willing to testify before the House Committee on Financial Services. Curiously, for someone usually so eager to jump on stages where he could trumpet his determination to make the world a better place, Mr. Bankman-Fried was far more tentative about the possibility of appearing before the Senate Banking Committee.

That little factoid, reported with no real explanation in the media accounts we saw, suggested to us that a little basic research might be in order. Like everybody else, we were eyeing the astronomical totals of political contributions ascribed to Mr. Bankman-Fried (hereafter SBF), his colleagues, and FTX, the crypto-currency exchange that SBF ran before it filed for bankruptcy. But past experience with mass media and scholarly analyses of campaign finance suggested to us a deep dive into the data would still prove highly instructive.

And so it turns out. In the interests of basic fairness and because so much data from the 2022 election cycle is still being posted on the websites of the Federal Election Commission and the Internal Revenue Service (which reports so-called “527” contributions usually neglected by journalists and scholars), we need to wave a few cautionary yellow flags about what we found.

Note first of all that as yet Mr. Bankman-Fried and his coworkers have not been convicted of anything, though the swiftness with which he and some of his colleagues made themselves scarce within the territorial United States as FTX imploded was striking. Recent comments and Congressional testimony by John J. Ray, the executive who is now presiding over the bankrupt shell of FTX, are also not encouraging. Indeed, coming from someone who helped liquidate Enron and a long line of other financial duds, they are downright chilling: “Never in my career have I seen such a complete failure of corporate controls and such a complete absence of trustworthy financial information as occurred here.”

We also take to heart warnings from public figures who admit they spent a lot more political money than the press recognized. While his recent public utterances clearly often mix poetry and truth, some of SBF’s statements on this score are noteworthy: “I donated to both parties. I donated about the same amount to both parties this year.” He added that “that was not generally known, because, despite Citizens United [the famous court case widely, if mostly mistakenly, blamed for opening the floodgates to giant waves of money in politics] being literally the highest-profile Supreme Court case of the decade and the thing everyone talks about when they talk about campaign finance, for some reason, in practice, no one could possibly fathom the idea that someone in practice actually gave dark.”[1]

“Dark money,” of course refers to contributions that are laundered through gifts to qualifying charities that are not themselves required to report where the money came from, only whom it went to. Election money analysts, accordingly, can see the money gushing out, but not the invisible spring it really comes from. As we have documented from time to time, Mitch McConnell along with many other politicos, including nowadays many Democrats, are past masters of stuffing campaign piggybanks in this stealthy way.

A passage from one of the indictments of SBF just unsealed underscores the need for wariness and, we would add, far more disclosure:

In furtherance of the conspiracy and to effect the illegal objects thereof, the following overt act, among others, was committed in the Southern District of New York and elsewhere: in or about 2022, SAMUEL BANKMAN-FRIED a/k/a “SBF,” the defendant,and one or more other conspirators agreed to and did make corporate contributions to candidates and committees in the Southern District of New York that were reported in the name of another person.[2]

In other words, the government contends, SBF and colleagues used dummies, too.

Here we can deal only with the on-the-record money. Dark money by definition stays dark unless some Congressional committee demands disclosure of how many of its own members and their colleagues really supped at the trough or prosecutors find the records.

But in the case of SBF and his colleagues, the public totals are quite something, even by the standards of American political finance.

Money in politics today is a Category 5 hurricane. Just when you think you have finally absorbed the worst punch the storm has to offer, some other eddy comes blasting down. We have tried to pull together the many streams of political money from SBF, his senior associates, and all other employees of FTX, together with the executives of Alameda Research, the crypto hedge fund that SBF had co-founded and remained involved with. We include individual donations and PAC contributions, but also the often gigantic 527 transfers reported to the IRS. We counted his brother, but not his parents. We have not looked at law firms that represented SBF or the firms or other possible sources of more money. And we warn readers that the group donated lavishly to think tanks, including the Center for American Progress. It also nourished a stable of former regulators, especially from its preferred regulatory venue, the Commodity Futures Trading Commission, and – secretly – at least one media outlet.

Still, our total is substantially higher than most others reported: over $89 million dollars since 2019, with the bulk of it coming during the 2021-22 political cycle when the campaign to keep crypto clear of federal regulation swung into high gear.

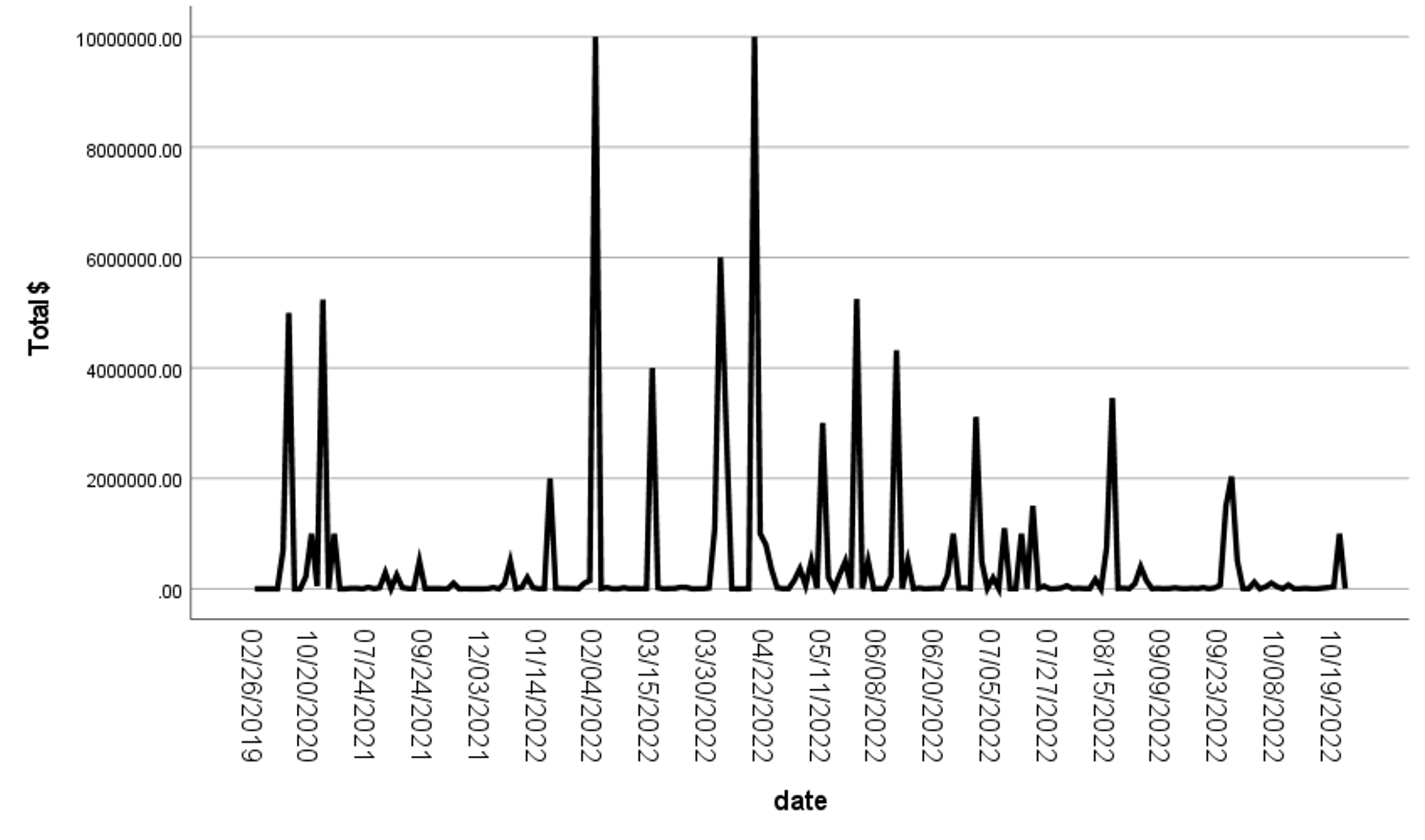

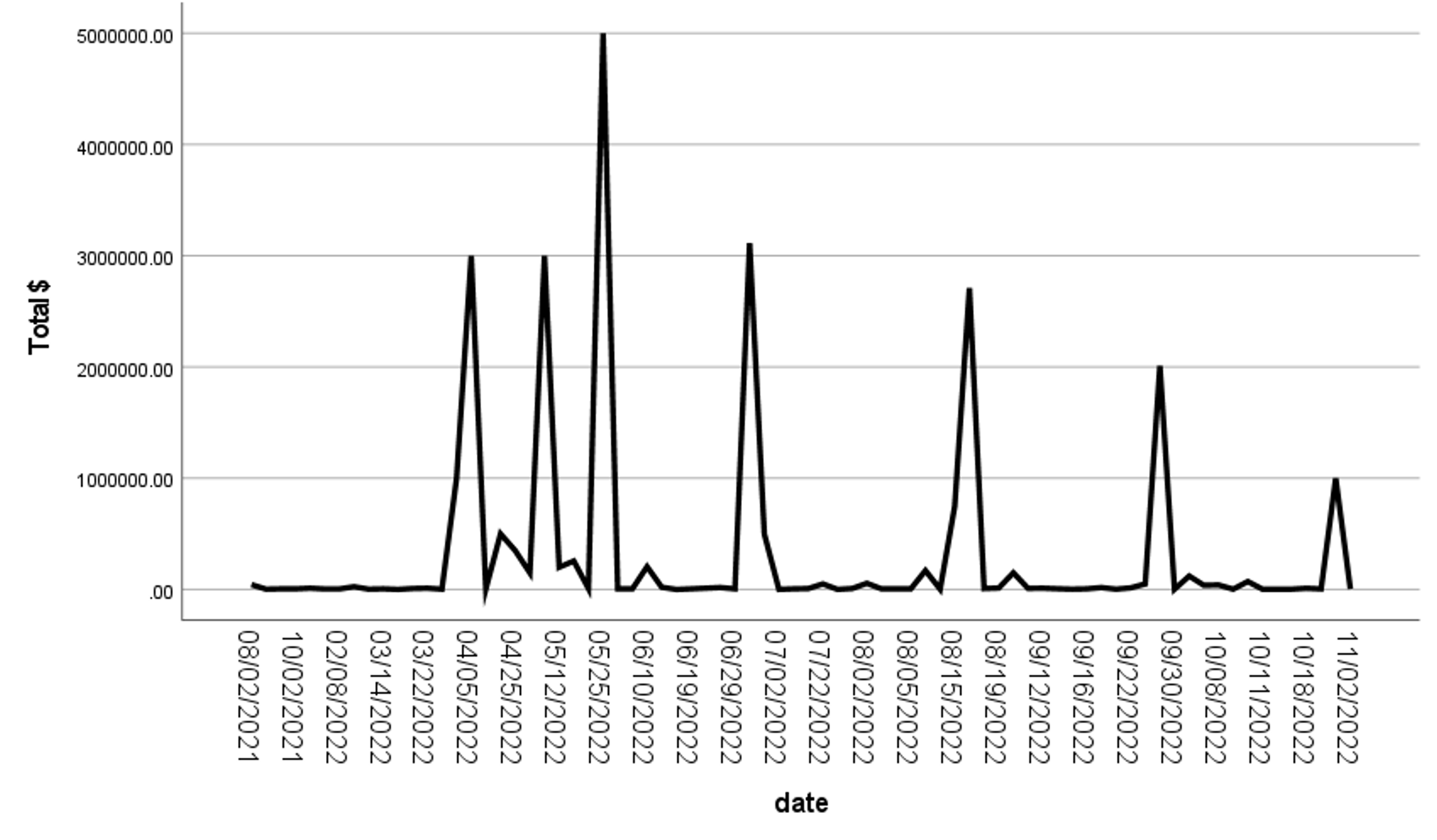

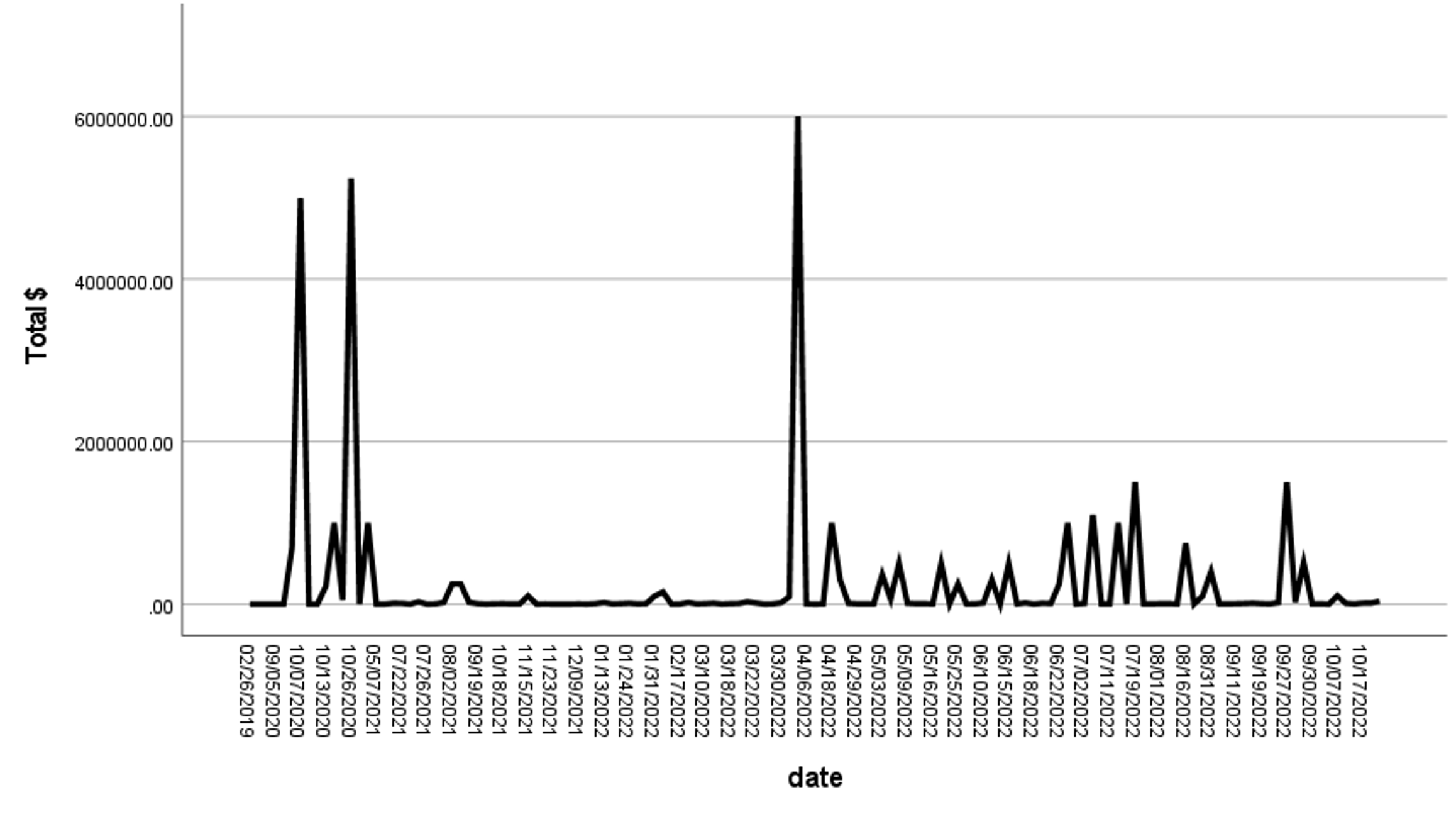

Three graphs clarify some of the issues debated in public. Figure 1 displays the time path of all the contributions we identified; Figures 2 and 3 display total contributions to Republicans and Democrats respectively. Figures 2 and 3 do not quite sum to the totals in Figure 1, since some streams of money could not be clearly pigeonholed in partisan terms. These last mostly represented donations to popular fundraising vehicles within the crypto industry or broader sectors of business that dispense money to politicians of both parties.

Figure 1 – Total Contributions

Figure 2 – Total $ to Republicans

Figure 3 – Total to Democrats

A strong current of Twitter feeds and press clips on the far, far right suggest that FTX was deeply involved with US-Ukrainian relations. So far, very little has come to light about FTX’s foreign subsidiaries or international dealings, save that some investors in the Bahamas were allegedly afforded a special opportunity to withdraw funds after the firm stopped withdrawals by other customers. But details of the public donations and their timing offer virtually no support to suggestions that eastern Europe was much on the mind of SBF and his colleagues. Many 2022 cycle contributions predate the outbreak of the war, though obviously not all do. Nor, though readers will have to take our word for it at least for now, the rivers of political money were not heading toward key foreign policy players in Congress. The FTX group focused on financial regulation. These little piggies were going to market: they wanted to keep crypto lightly regulated while dramatically expanding their field of action.

The alleged progressive tilt of the group’s donations was a smokescreen, as SBF’s confession quoted earlier testifies. The trough was quite bipartisan, even if tilted toward Democrats. The public data show that many Republicans received large sums from the donor group. Election financing vehicles controlled by McConnell, McCarthy, and other Republicans received substantial amounts, as did some very prominent representatives noisily involved in the battle to regulate crypto, such as Representative Tom Emmer (R-MN), Ritchie Torres (D-NY), and Josh Gottheimer (D-NJ). Stories suggesting that the group tilted toward liberal Democrats are also nonsense. That is not true even for SBF alone; his own contributions to Republican groups were substantial, including over $105,000 to Alabama Conservative Fund, the Super PAC supporting the newly elected Katie Britt in June 2022. When he gave to Democrats, the money flowed almost entirely to corporate Democratic groups and centrist Democratic politicians, not AOC or Justice Democrats.

A look at the institutional context clarifies what was really at stake in all this hyperactivity. FTX’s real aim was to put across a drastic rewrite of longstanding regulations governing commodity clearing houses in favor of a new system that would allow it to “offer direct clearing access to margined futures contracts.” This was no detail; it implied a sweeping change in the “structure of the entire futures market” that would vastly increase “the participation of retail speculators in futures markets, which have historically been markets for physical producers and purchases to hedge price risk, almost always by institutional participants who have the financial resources and sophistication to protect themselves.”[3] Or in other words, invite a vast new herd of eager, but inexperienced lambs to run free in the heady world of leveraged derivatives using crypto, alongside very experienced and well-capitalized wolves.

What could possibly go wrong?

Other major exchanges opposed this but warned that if the Commodity Futures Trading Commission allowed FTX to do this they would follow suit. Regulatory legislation on the books gave significant roles to both the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission. But the crypto industry constantly contested the authority of the SEC. It sought to shunt exclusive jurisdiction to the CFTC, which was more than happy to play along.[4] Thus the FTX group (along with many others in the industry) heavily supported representatives of both parties who favored locating regulation in the Commodity Future Trading Commission.

The Agricultural Committees in Congress principally oversee the CFTC, not the Banking committees. So the FTX groups donated heavily to members of those committees, including at least 19 members of the House Agriculture Committee. The ranking member of that committee, Glenn Thompson (R-PA), took in over $61,000 of direct contributions, for example. Other top recipients on the House Agriculture Committee included Josh Harder (D-CA), Salud Carbajal (D-CA), and Angie Craig (D-MN).

Senate Agriculture was a big winner: McConnell ($3,626,100 – you read that right); Democrat Debbie Stabenow, whose former aide chairs the CFTC ($38,200); John Boozman ($33,200), John Thune ($14,200), and Kirsten Gillibrand ($13,700). By comparison, only six members of the Senate Banking Committee received contributions. Jon Tester led the way with a paltry $8,300.[5]

The FTX group did direct some serious money to the House Financial Services Committee: Ann Wagner (R-MO) led the way with $50,000, but not far behind were some of the most vocal critics of the SEC: Ritchie Torres receiving nearly $30,000, Josh Gottheimer collected $16,600, with Tom Emmer garnering $11,600. An unsympathetic observer might thus conclude, in the spirit of the “revealed preference” theory common in modern economics, that that is the reason SBF preferred to talk to the House, but not Senate Banking Committee. In the House, his appearance would have been more like a Christmas visit from Santa.

If all this brings to mind the long, disgraceful battles over derivatives regulation in the nineteen nineties, it should. It is a near carbon copy of that earlier travesty, right down to the vast clamor from the media and think tanks that all but drowns out critics. The industry was on the verge of getting its way when the crypto dominoes started tumbling down, temporarily slowing its momentum.

But the crypto story, if not FTX’s, is really a zombie movie. Despite everything that’s happened, crypto forces in Congress are still pushing to change the rules on exchanges and to allow pension funds to invest in crypto. Borrowing another leaf from the nineties, they are striving to pin the blame on the disaster that’s occurred on the stronger regulator, the SEC, for not acting, even though they spent years trying to block it from doing so. It strikes us, accordingly, that the first item of business ought to be the demand for full disclosure of all political money SBF, his colleagues, and their firms contributed to everyone on the Congressional committees and in the rest of the political system, together with a full accounting of grants to think tanks and researchers. And the second should be drastic changes at the CFTC, which has once again failed to protect the public.

Be the first to comment