Book Review by Michael Roberts

Back in 2014, French economist Thomas Piketty published a blockbuster book, Capital in the 21st century. Repeating the name of Marx’s Capital, the implication of the title was that it was an updating Marx’s 19th century critique of capitalism for the 21st century. Piketty argued that the inequality of income and wealth in the major capitalist economies had reached extremes not seen since the late 18th century and unless something was done, inequality would continue to rise.

The book had a huge impact, not just among economists (particularly in America, less so in France) but also among the general public. Two million copies were sold of this monumental 800p publication which was full of theoretical arguments, empirical data and anecdotes to explain increased inequality of wealth in modern capitalist economies. The book eventually won the dubious honour for the most bought book that nobody read, taking over from Stephen Hawking’s The Brief History of Time. I suppose Marx’s Capital is also part of this club.

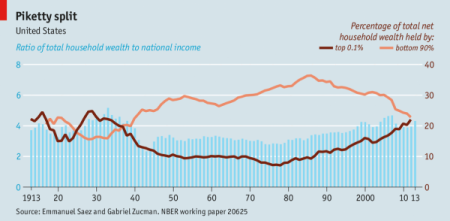

Many critiques of Piketty’s arguments followed, both from the mainstream and the heterodox. Piketty has made a great contribution in the empirical work that he, fellow Frenchman Daniel Zucman and Emmanuel Saez have made in estimating the levels of inequality in capitalist economies. And before that, there was the father of inequality studies, the recently deceased Anthony Atkinson, (whose work was the foundation of my own PhD thesis on inequality of wealth in 19th century Britain).

But, as I argued in my own critique of Piketty, which was published in Historical Materialism at the time, Piketty was not following Marx at all – indeed, he trashed Marx’s economic theory based on the law of value and profitability. For Piketty, the exploitation of labour by capital was not the issue but the ownership of wealth (ie property and financial assets), which enabled the rich to increase their share of total income in an economy. So it was not the replacement of the capitalist mode of production that was needed but the redistribution of the wealth accumulated by the rich.

Piketty’s fame among the mainstream soon faded. At the 2015 annual conference of the American Economic Association, Piketty was feted, if criticised. Within a year, all was forgotten. Now, six years later, Piketty has followed up with a new book, Capital and Ideology, which is even larger: some 1200pp; as one reviewer said, longer than War and Peace. Whereas the first book provided theory and evidence on inequality, this book seeks to explain why this had been allowed to happen in the second half of the 20th century. And from that, he proposes some policies to reverse it. Piketty broadens the scope of his analysis to the entire world and presents a historical panorama of how ownership of assets (including people) was treated, and justified, in various historical societies, from China, Japan, and India, to the European-ruled American colonies, and feudal and capitalist societies in Europe.

His premise is that inequality is a choice. It’s something ‘societies’ opt for, not an inevitable result of technology and globalisation. Whereas Marx saw ideologies as a product of class interests, Piketty takes the idealist view that history is a battle of ideologies. The major economies have increased inequalities because the ruling elites have provided bogus justifications for inequality. Every unequal society, he says, creates an ideology to justify inequality. All these justifications add up to what he calls the “sacralisation of property”.

The job of economists is to expose these bogus arguments. Take billionaires. “How can we justify that their existence is necessary for the common good? Contrary to what is often said, their enrichment was obtained thanks to collective goods, which are the public knowledge, the infrastructures, the laboratories of research.” (Shades of Mariana Mazzucato’s work here). The notion that billionaires create jobs and boost growth is false. Per capita income growth was 2.2% a year in the U.S. between 1950 and 1990. But when the number of billionaires exploded in the 1990s and 2000s — growing from about 100 in 1990 to around 600 today — per capita income growth fell to 1.1%.

Piketty says that the type of free-market capitalism that has dominated the US since Ronald Reagan needs to be reformed. “Reaganism begun to justify any concentration of wealth, as if the billionaires were our saviours.” But; “Reaganism has shown its limits: Growth has been halved, inequalities have doubled. It is time to break out of this phase of sacredness of property.”

He does not want what most people consider ‘socialism’, but he wants to “overcome capitalism.” Far from abolishing property or capital, he wants to spread its rewards to the bottom half of the population, who even in rich countries have never owned much. To do this, he says, requires redefining private property as “temporary” and limited: you can enjoy it during your lifetime, in moderate quantities.

How is this to be done? Well, Piketty calls for a graduated wealth tax of 5% on those worth 2 million euros or more and up to 90% on those worth more than 2 billion euros. “Entrepreneurs will have millions or tens of millions,” he said. “But beyond that, those who have hundreds of millions or billions will have to share with shareholders, who could be employees. So no, there won’t be billionaires anymore.” From the proceeds, a country such as France could give each citizen a trust fund worth about €120,000 at age 25. Very high tax rates, he notes, didn’t impede fast growth in the 1950-80 period.

Piketty also calls for “educational justice” — essentially, spending the same amount on each person’s education. And he favours giving workers a major say over how their companies are run, as in Germany and Sweden. Employees should have 50% of the seats on company boards; that the voting power of even the largest shareholders should be capped at 10%; much higher taxes on property, rising to 90% for the largest estates; a lump sum capital allocation of €120,000 (just over £107,000) to everyone when they reach 25; and an individualised carbon tax calculated by a personalised card that would track each person’s contribution to global heating. He calls this moving beyond capitalism to “participatory socialism and social-federalism”.

This all smacks of returning capitalist economies to the days of the so-called ‘golden age’ from 1948-65, when inequality was much lower, economic growth was much stronger and working class households experienced full employment and were able to get educated to levels that enabled them to do more skilled and better paid jobs. There was a ‘mixed economy’, where capitalist companies supposedly worked in partnership with trade unions and the government. This was a myth. But if you accept Piketty’s premise that this social democratic paradise existed and its demise was brought about by a change of ideology, it is possible to consider that “redistributive ideas’ could gain support after the experience of the Great Recession and the rise of extreme inequality now.

Piketty argues that the social democratic parties dropped their original aims of equality and opted instead for meritocracy ie hard work and education will deliver better lives for the working class. And they did so because they had gradually transformed themselves from being parties of the less-educated and poorer classes to become parties of the educated and affluent middle and upper-middle classes. To a large extent, he reckons, traditionally left parties changed because their original social-democratic agenda was so successful in opening up education and high-income possibilities to the people, who in the 1950s and 1960s came from modest backgrounds. These people, the “winners” of social democracy, continued voting for left-wing parties but their interests and worldview were no longer the same as that of their (less-educated) parents. The parties’ internal social structure thus changed— it was the product of their own political and social success.

Really? The failure of social democratic parties to represent the interests of working people goes way back before the 1970s. Social democratic parties supported the nationalist aims of the warring capitalist powers in WW1; in Britain, the leaders of the Labour Party went into coalition with the Conservatives to impose austerity and break the trade unions in 1929. After WW2, social democracy moved from Attlee to Wilson to Callaghan to Kinnock and finally to Blair and Brown. It was a similar story in continental Europe: in France from Mitterand to Hollande; in Germany from Brandt to Schmidt.

This was not just because the composition of the SD parties changed from industrial workers to educated professionals. The very health of post-war capitalist economies changed. The brief ‘golden age’ came to an end, not because of a change of ideology (or as Joseph Stiglitz has put it, ‘a change of rules’) but because the profitability of capital plummeted in the 1970s (following Marx’s law of profitability as outlined in Capital). That meant that pro-capitalist politicians could no longer make concessions to labour; indeed, the gains of the golden age had to be reversed in the ‘neoliberal’ period. So ideology changed with the change in the economic health of capital. And social democratic leaders went along with this change because, in the last analysis, they do not think it is possible to replace capitalism with socialism. “There is no alternative” – to use Thatcher’s phrase.

At least, Piketty reckons it is possible to go beyond capitalism, unlike Branco Milanovic who, in his latest book, Capitalism Alone that I reviewed recently, agrees with Thatcher and reckons capitalism is here to stay. “You have to go beyond capitalism,” says Piketty. In an interview, when asked “Why this word ‘beyond”, why not “To get out of capitalism”? Piketty replied: “I say “go beyond” to say go out, abolish, replace. But the term “exceed” me allows for a little more emphasis on the need to discuss the alternative system. After the Soviet failure, we can no longer promise the abolition of capitalism without debating long and precisely what we will put in place next. I’m trying to contribute.”

Piketty reckons the “propriétariste and meritocratic narrative” of the neo-liberal period is getting fragile. “There’s a growing understanding that so-called meritocracy has been captured by the rich, who get their kids into the top universities, buy political parties and hide their money from taxation.” That leaves a gap in the political market for redistributionist ideas.

But Piketty’s answers are just that: a redistribution of unequal wealth and income generated by the private ownership of capital, not replacing the ownership and control of the means of production and the exploitation of labour in production with a system of common ownership and control. Apparently, the big multi-nationals will continue, big pharma will continue; the fossil-fuel companies will continue; the military-industrial complex will continue. Regular and recurring crises in capitalist production and accumulation will continue. But, as these vested interests of capital are still not generating enough profitability to allow any significant increase in the taxation of extreme wealth and income that they control, what chances are there that the current ‘ideology’ of the ‘sacralisation of property’ can be overcome, without taking them over?

Capital in the 21st Century by Thomas Piketty

Published by Harvard University Press

ISBN: 978-0674979857

Be the first to comment