We shall be seeing much more of this with companies that had taken on too much debt. This is surely just the tip of the iceberg.

Frances Coppola is the author of the Coppola Comment finance and economics blog, which is a regular feature on the Financial Times’ Alphaville blog and has been cited in The Economist, the Wall Street Journal, The New York Times and The Guardian. Coppola is also Associate Editor at the online magazine Pieria and a frequent commentator on financial matters for the BBC

Cross-posted from Frances’s Blog Coppola Comment

Aerial image of the Trafford Centre from Wikipedia

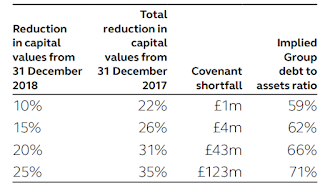

These facilities have significant covenant headroom. For example, a further fall of 10 per cent in capital values would create a covenant shortfall of only £1 million.

|

- A further fall of 10% in property values would result in covenant breaches costing £174m to resolve, including repayment of the £161m drawn balance on the revolving credit facility.

- A further decline of 10% in rental income would cost an additional £34m in debt service covenant breaches.

- £331.5m of repayments would fall due on 31 March 2021 and £1,116.7m on 31 December 2021, including £573.2m outstanding under the revolving credit facility

- Early termination of swaps could cost another £93m

- “alternative capital structures”, probably involving some kind of debt/equity conversion, and possibly a rights issue

- fire sales of assets

- persuading lenders to waive or amend the covenants (the note says this would have to be done before the next covenant test, due in July 2020)

- “other self-help measures”, including a lower level of capital expenditure “in the short term”. This seems to be very much a last resort, probably because capital projects can be very costly to defer.

Discussions have been ongoing with financial stakeholders to achieving standstill-based agreements. However, insufficient alignment and agreement in relation to the terms of such standstill-based agreements has been achieved with financial stakeholders ahead of the above deadline.

Be the first to comment