The failure of Argentina’s economy

Michael Roberts is an Economist in the City of London and a prolific blogger.

Cross-posted from Michael’s blog

Argentines will vote in general elections today with both the mainstream parties weakened by the legacy of multiple economic crises and challenged by a libertarian outsider, Javier Milei.

The deeply unpopular current president Alberto Fernández, of the centre-left Peronist movement, has opted not to run in the presidential election after almost four years in power. Former president and current vice-president Cristina Fernández de Kirchner, leader of Peronism’s more radical left wing, is also absent from the ballot. Instead, the Peronist candidate is economy minister Sergio Massa, from the right-wing.

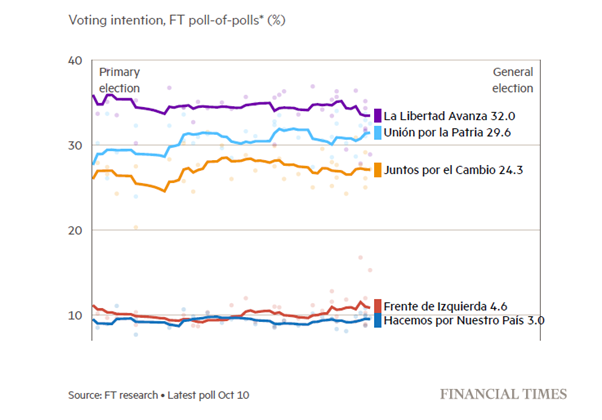

Also running is former security minister Patricia Bullrich, who is on the right of Argentina’s pro-business opposition coalition, Juntos por el Cambio (JxC). But it is Milei that leads in the polls

To win the presidency outright, a candidate would need 45 per cent of the vote, or 40 per cent with a 10-point lead over their nearest rival. Most pollsters expect Milei to come first and enter a second-round run-off against either Massa or Bullrich on 18 November. He could then win the run-off.

Milei has come from nowhere in a matter of months to take the pollster lead. His rise expresses the desperation that many Argentines feel about the state of their country and their living standards and the outright failure of previous Peronist and ‘pro-business’ presidents.

Milei’s party, La Libertad Avanza (Freedom Advances), movement is totally built around his personality. His eccentric career includes turns as a tantric sex guru and cosplay enthusiast, support for radical ideas such as legalising the sale of human organs. He opposes abortion and favours liberalising gun ownership.

A self-styled ‘anarcho-capitalist’, Milei believes in unfettered free markets, unrestricted free trade and giving primacy to ‘private property and individual freedom’. His beloved English Mastiff dogs, cloned from the DNA of a dead pet named Conan, carry the names of leading conservative economists: Milton Friedman, Murray Rothbard and Robert Lucas.

After teaching economics to university students and working for Corporación América, Milei found fame as a commentator on television chat shows, making scathing diagnoses of Argentina’s economic woes and arguing that the solutions for fixing them were simple: get rid of the central bank (he smashed a piñata of the central bank on television on his birthday) and ‘dollarise’ the economy. He wants to slash government services to the minimum and reduce welfare handouts.

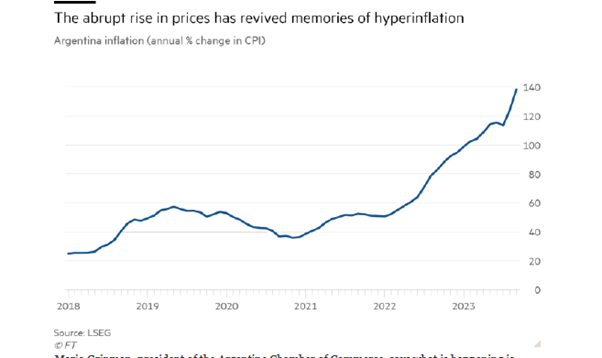

His current popularity is due to the state of Argentina’s economy. Inflation is forecast to reach 210 per cent by the end of this year, estimates JPMorgan.

The Argentine peso has plummeted in value against the dollar, fueling yet more inflation through imported goods.

In attempting to keep the peso from meltdown, the central bank has bought pesos with its dollar reserves. But now net foreign currency reserves are about $7.6bn in the red and the government is struggling to service snowballing debts to local bondholders.

The country is facing massive repayment obligations to the IMF and foreign bondholders after the $44bn IMF programme used to bail out the previous right-wing Macri government evaporated in rising government deficits and in capital flight abroad.

The Peronist government under economy minister Massa has presided over central bank money-printing to fund the deficit, something that has pushed up inflation further and devalued the peso. By the way, this lends the lie to Modern Monetary Theory (MMT) that argues governments can ‘print’ as much money as they need to cover government spending.

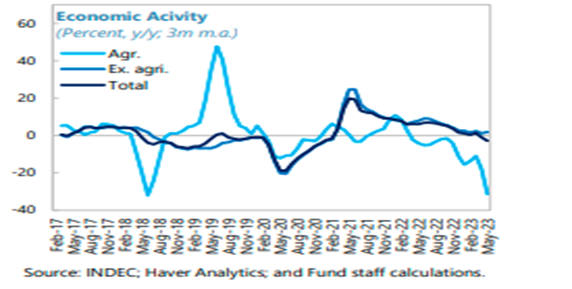

Meanwhile, Argentina posted its worst monthly trade deficit on record in June, underscoring the impact of a record summer drought hitting agro exports and driving the economy into a recession.

Indeed, a debt default has only been avoided so far by using short-term swap yuan loans from the Chinese government.

Is there any way out of these recurring crises for Argentina’s near 50m citizens? Milei says the solution to hyper-inflation and a falling peso is dollarisation. After all, he says, people no longer trust that the peso will ever be worth holding. As soon as they get paid their salaries in pesos or peso flows from somewhere, people want immediately to exchange those pesos into dollars. As a result, the Argentine economy is already very highly dollarised. Milei intends to call for a referendum to achieve this formally.

What would be the advantages of dollarisation? It would, in principle, solve the domestic inflation problem. This does not mean that there will be no inflation, but given the absence of exchange-rate fluctuations, the gravity centre for prices in dollars would then be US inflation, which is much lower.

A second positive element of dollarisation would be the reduction of the domestic interest rate, and so supposedly increasing investment and potential GDP levels. A third supposed benefit, only observable in the long run, would be the elimination of currency crises and the macroeconomic instability that they bring.

Dollarisation would go some way to defeating inflation. For example, Ecuador dollarised its economy in January 2000 and price stability was achieved by 2004. From then on, inflation has been on average 3.1 per cent a year, lower than the 28 per cent average between 1970 and 1999, and similar to Chile’s 3.3 per cent), Colombia’s (4.4 per cent) and Peru’s (2.9 per cent) in the same period.

But dollarisation would also mean immediate recession and slump. It would have to start with a massive devaluation of the domestic peso monetary base. In a very optimistic scenario, if Argentina received a loan of say $12 billion from the IMF and used $5 billion as a reserve for the banking system and $7 billion to dollarise the monetary base, the domestic peso monetary base would still have to be reduced by over 80%. Argentine salaries (then in US dollars) would become among the lowest globally and poverty would rise to unprecedented levels. And Argentina is already in a recession with real GDP expected to drop by around 2% this year. So either way: peso or dollar, Argentine households would pay the price in living standards.

Moreover, Ecuador’s dollarisation has been no great success for its economy. Ecuador was lucky when it dollarised because it could rely high oil revenues during the commodity price boom up to the mid-2010s. But after that, Ecuador was forced into cutting spending and raising taxes, which has aggravated a drop into recession in the last few years. Indeed, Ecuador has grown some 40% less than the rate achieved in the pre-dollarised years and Ecuador’s per capita income in 2019 was lower than in 2012.

Moreover, dollarisation means that economic policy would be in the hands of US Federal Reserve and dollar foreign investors. National monetary policies would be basically abandoned. Countries issuing their own currency can allow it to depreciate to improve exports and domestic production at least in the short term. But a dollarised economy must go down with any global recession. A strong US dollar also means high export prices for a dollarised Argentina, making it more uncompetitive in world markets – unless labour costs are reduced by wage cuts or by faster productivity growth that keeps unit labour costs low.

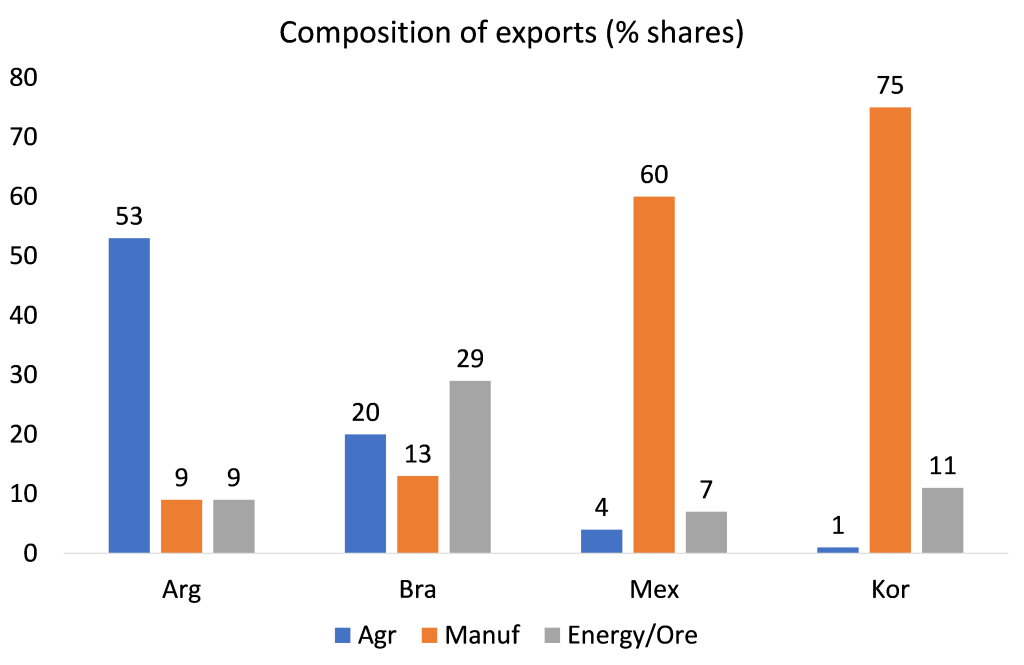

The real question that is not answered by any of the candidates is: why Argentina has got into an inflationary spiral for decades interspersed with debt crises and slumps. Part of the answer is that Argentina never industrialised like East Asia, or even Brazil. The Peronist governments failed to get Argentine capitalists to invest in productive sectors, despite Argentina’s plentiful natural resources and an educated workforce. The number of formal jobs in the private sector has barely grown in more than a decade, and more than half of employed Argentines work either off the books or for the state. Instead, there was reliance on agriculture which provided cheap food for the ‘Global North’. Agriculture is subject to the vagaries of the weather and dominated by a few agro multi-nationals. Look how the recent summer drought has meant for agricultural output and the economy.

In 1976, Argentine GDP was $51 billion and South Korea’s $30 billion. Today, the Argentine economy weighs in at about $80 billion annually. In South Korea, after half a century of industrialisation, annual GDP stands at $1.6 trillion. Argentina’s per capita GDP is today almost the same as it was in 1974, with the additional problem of inequality between the rich and the poor being considerably greater.

The imbalance in Argentina’s economy is revealed by its high dependence on agricultural exports to get dollars. Over half of exports are from agricultural goods, way more than other LA economies, while the share of manufacturing exports is tiny. Directly or indirectly, Argentine agriculture employs only two million people, or 14% of the working population and contributes only 10% of GDP. Yet for every $10 Argentina banks through exports, nearly $6 comes from agriculture. Without agricultural exports, Argentina would garner scarcely any foreign currency.

Argentina’s investment to GDP ratio has been consistently below the other major Latin American economies.

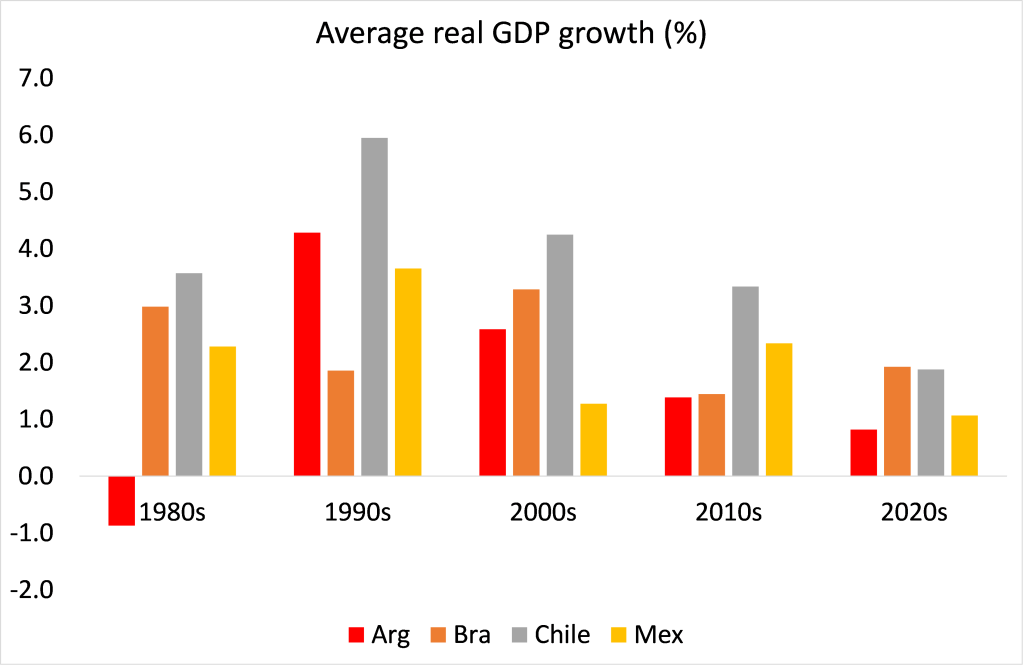

As a result, real GDP growth has been poorer, particularly in the 21st century, although that applies to all the major LA economies..

Argentina’s capitalists have not invested productively because the profitability of doing so has been so poor. Here is the track record of the profitability of Argentine capital from the World Profitability Database.

After the post-war golden age, Argentine capital suffered the same downward track in profitability from the 1960s to the early 1980s that all the major economies did. Then there was the neo-liberal recovery period, which ended with a major currency and debt crisis in 1999. That was briefly resolved by devaluation, debt default and slump. The commodity boom of the 2000s helped the economy along for a while, but when that ended in 2010, the fall in underlying profitability reasserted itself.

Mainstream economists see the solution in fiscal austerity, high interest rates, privatisation and ‘deregulated markets – traditional neo-liberal policies. They argue that without this, dollarisation would not work. So basically, they advocate a slump and a further reduction in real wages to boost profitability.

Peronism has failed to deliver on economic expansion, a stable currency and low inflation. But it has also failed to deliver on ending poverty and reducing inequality. Argentina’s official poverty rate rose to 40.1% in the first half of 2023. According to the World Inequality Database, the top 1% have 26% of net personal wealth, the top 10% have 59%, while the bottom 50% have just 5%. In incomes, the top 1% have 15%, the top 10%, 47% and the bottom 50%, just 14%.

Desperation has driven many Argentines to consider a ‘libertarian, anarcho-capitalist’ as president. If this were to happen, it will be going down another blind alley. Argentina’s capitalist economy will continue to fail.

Be the first to comment